By Natasha Rombough, Director of Marketing and Communications, CHBA

The ninth annual CHBA Home Buyer Preference Survey is a fascinating glimpse into the minds of recent homebuyers and what they value. This survey is Canada’s largest nationwide market research study for new-home buyer preferences. Conducted by CHBA and powered Avid Ratings Canada, a proud member of CHBA and part of CHBA’s Alliance Network, the survey has invited more than 188,000 new-home buyers from across the country to participate during its nine-year history. This report surveyed more than 18,000 people from across six provinces who had purchased a new construction home within the last two years. Respondents were asked questions on more than 50 in-depth areas of home design, building features, buying preferences and demographics.

The report touches on all elements of the survey, providing data on responses from all participants. More than 60 pages and filled with graphs illustrating the results and complimented by stunning architectural and design photography, it’s an insightful – and sometimes surprising – resource. But it’s when you use the PowerBI database that comes with the report that things really get interesting. Introduced last year, the easy-to-use tool allows you to look at data based on the demographic selections. For example, you can look at whether millennials in Alberta want large lots, or how many bathrooms Boomers in Ontario want in their next home.

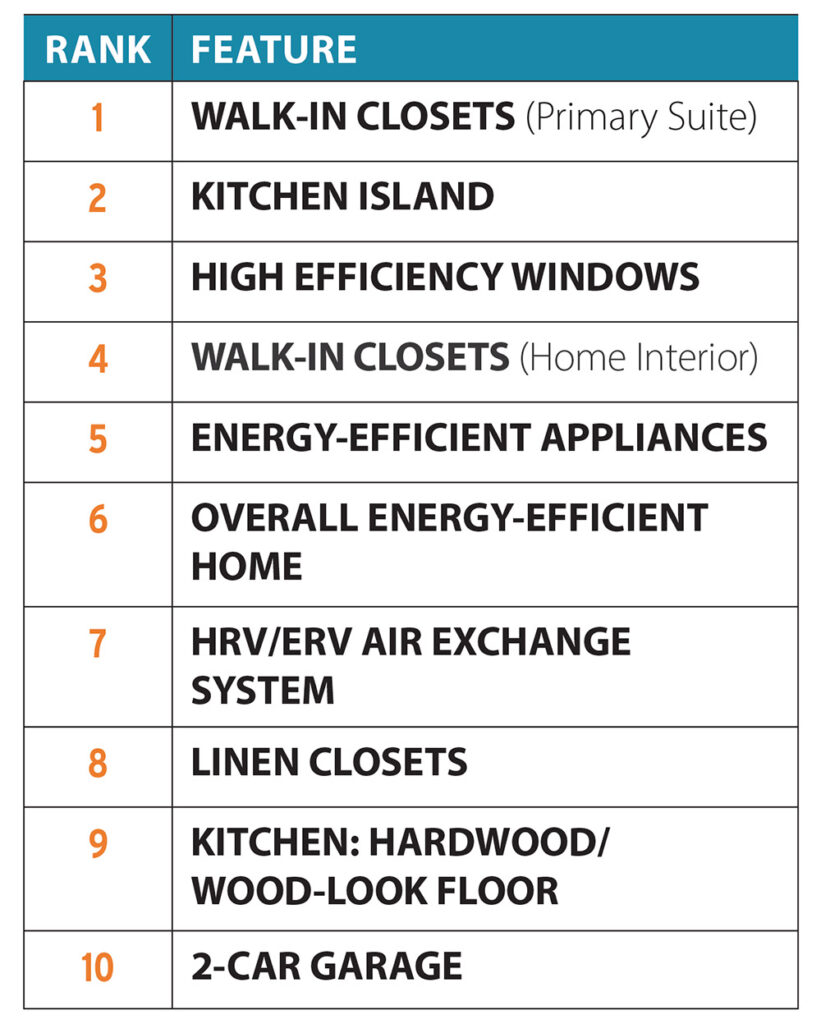

Top 10 most desired features

We all love a good list, and the Top 10 home features in Canada is the most requested piece of information from this survey (though we urge you to explore the content much further). For the second year in a row, a walk-in closet in the primary suite takes the top spot. As with last year, storage throughout the home remains a key priority for Canadians, with closet and garage space taking four of the top spots. Though there was some jostling of position (high efficiency windows are in third spot this year), energy efficiency features continue to feature strongly as well, also accounting for four of the 10. New to the top 10 this year is hardwood or wood-look floors in the kitchen, bumping out open concept kitchens, which landed in eleventh, just missing the list.

Free access of the full survey results for members

Find out more about what home buyers really want, and what they’re willing to trade to get it, by downloading your digital copy of the study today. The download includes the link to the powerful online data set that you can use to splice and dice the information however you want. Full survey results are free for CHBA members (value of $495) at chba.ca/buyersurvey.

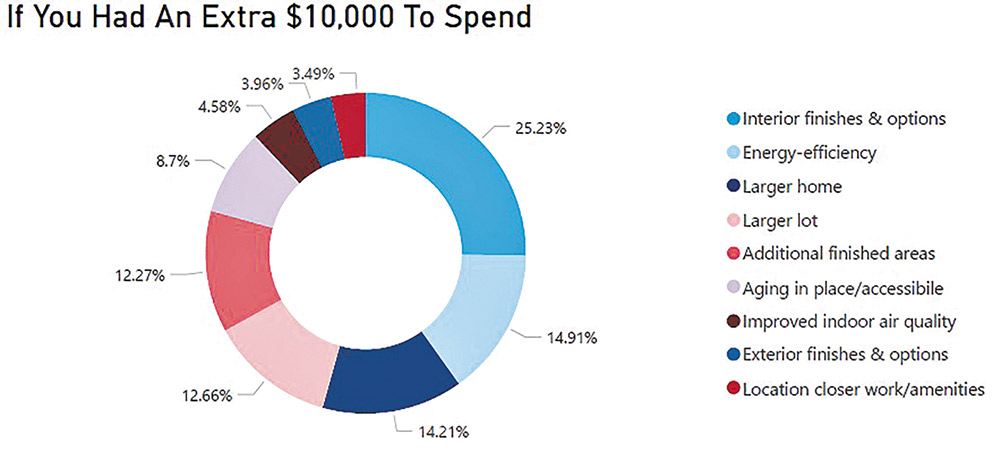

Where buyers want to spend their money

Price is a huge factor in the final purchase decision. The sale price of the home is extremely important to buyers; over the last nine years of the survey, respondents have consistently indicated that pricing information is by far the most influential factor when they make a purchase.

The survey asks what recent buyers would be willing to accept to make their next home more affordable. This question forces respondents to prioritize what’s most important to them, and the results were very similar to last year’s survey. The most popular answer was a smaller home, followed closely by being located farther from work or amenities. Very few people were willing to compromise on construction material quality or the energy efficiency of the home.

The survey also asks how buyers would use an extra $10,000 if they had it. Interior finishes and options remain the most popular option, followed by energy efficiency and then a larger home. Aging-in-place and accessibility features was first introduced as an option three years ago, and accounts for almost nine per cent (that number rises to 22 per cent among Boomers). Overall, Canadians are least interested in using extra money on their exterior finishes and being closer to work.

Home size needs differ, but everyone wants more bathrooms

The survey asks buyers about the home they just built, and about what they think they’ll want in their next home. More than 45 per cent of respondents believe they’ll be making their next home purchase within five years, so their opinions – especially since they just went through the buying process – are relevant to home construction design already.

Slightly more than 60 per cent want their next home to be under 2,400 sq. ft., though that’s three per cent less than last year. The most anticipated size is 2,101 to 2,400 sq. ft., which is a change from last year’s 1,801 to 2,100. Both of these factors indicate that the size of home desired is going up, which might be a reflection of the large millennial cohort being in their prime family-building years.

Demographics can really change the picture, though. Boomers want smaller homes than the average, with 61 per cent preferring their next home to be under 1,800 sq. ft. (11.5 per cent of those want less than 1,200 sq. ft.). More than 30 per cent want a home to support aging in place, and 16 per cent would be looking to downsize. However, more than half still want that small home to have three bedrooms (overall, the most popular number of bedrooms is four). If you want to appeal to Boomers, stick to main-floor living that doesn’t require stairs: 60 percent would be looking to purchase a detached or semi-detached bungalow.

Bathrooms continue to be in demand, challenging builders to find ways of adding multiple into even the smallest of homes. Only 10 per cent of buyers would be satisfied with two or fewer; most want between 2.5 and 3.5 bathrooms. This is a feature where new construction can really stand out from existing homes, since older houses tend to have fewer bathrooms than homes built today of comparable sizes.

Do you know where buyers are finding you?

According to an old marketing adage that is still widely accepted, they say it takes seeing something seven times, in seven different ways, to not only be remembered, but to result in a sale. The good news is that there are plenty of different ways to reach people these days. The challenge is figuring out where to prioritize your advertising efforts. That’s where the CHBA Home Buyer Preference Survey can help you out. The survey asks recent buyers what resources were important to them in their search for a new home, we’re able to rank their preferences.

The top preferred resource for finding a builder is still visiting model homes and sales centres, though it’s important to note that this method has seen a gradual trend down over the nine years of the survey. Visiting model homes and sales centres is also how most people begin their search for a new home, ahead of Internet searches, which for the first time this year is the second-highest preferred resource for finding a builder, just edging out the option of driving through the community, which had been in the second spot since this survey began.

The Internet and builder websites both remain important resources for finding a home. While using a real estate agent as a preferred resource for finding a builder had one of the largest gains in score last year – perhaps a residual preference from the competitive market during the end of the pandemic – it has returned closer to its average rating this year. Direct mail, magazines, and newspapers are the lowest scored once again this year, but remember: If it takes someone seven times and seven methods to make a purchasing decision, these resources should still be part of your toolkit if you’re able to include them. They’re far from a passé resource, and marketing professionals are creating innovative campaigns that link these paper resources with online calls to action.

If you need inspiration, check out this year’s marketing awards finalists from the CHBA National Awards for Housing Excellence.