By Viktoria Halim,

CHBA Director, Economic and Urban Affairs

In the first quarter of 2020, CHBA launched Canada’s first ever builder sentiments indicator – the CHBA Housing Market Index (HMI) for both the single-family and multi-family markets in the country. The HMI has given CHBA the means to explain the residential construction industry’s perceptions, experiences and issues using quantifiable data, providing insight and near-term trends of the industry well before the starts and permits data that we were previously limited to. Insight coming from the HMI has been a great tool to inform the government, media and consumers about trends and issues in the residential construction industry, and another aid to further CHBA’s government advocacy.

Q1 2022 results

Builder confidence was still on the rise in Q1 2022, as a result of strong consumer traffic and a sense from the industry that it will be a positive year ahead for new construction. This, despite a number of challenges that remain: The cost of materials continues to increase, while labour shortages persist. CHBA continues to support members by advocating for increased housing supply and for addressing supply chain issues across the country.

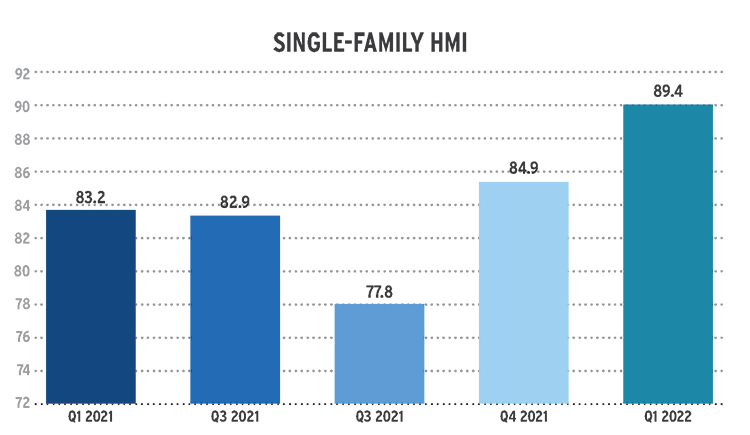

Single-family market: Year-over-year trends

Single-family builder sentiment was strong throughout the year and was in the 80s for all but one quarter. The index fell in Q3 to 77.8, but then rose to historical highs in Q4 2021 and Q1 2022 (up seven points since Q1 2021). The drop in Q3 of 2021 was reflective of challenges with the supply chain and labour, which dampened sentiment – challenges that still remain but are being offset by continuously increasing demand for single-family homes across the country which is keeping builder sentiment high. Q1 2022 saw a new HMI high of 89.4.

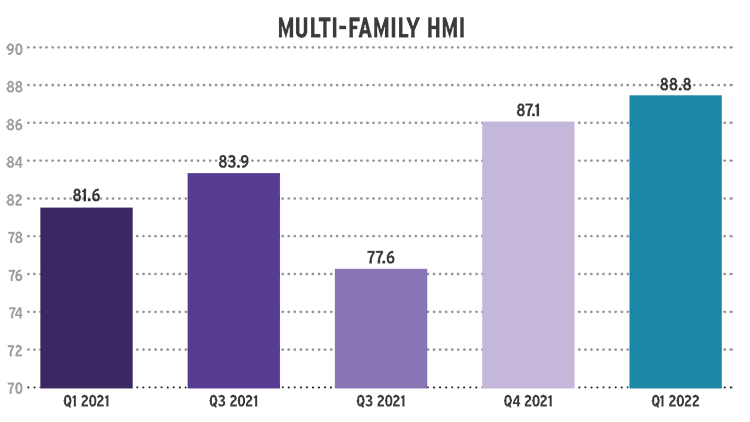

Multi-family market: Year-over-year trends

As with the single-family builders, the multi-family market started the year off positively, being stronger than the single-family market in Q2 of 2021, but this was followed by a slight decline in builder sentiment in Q3 of 2021. The Q3 decline reflected the uncertainty around certain aspects of the housing market – such as the stress test introduced at the time – including supply chain issues. However, in Q1 of 2022 the multi-family HMI is at a record-high 88.8, up nine points YOY, as the exodus from downtown cores due to the pandemic subsided, and partly as a result of a recovery in youth employment and renewed immigration – two key rental-source populations.

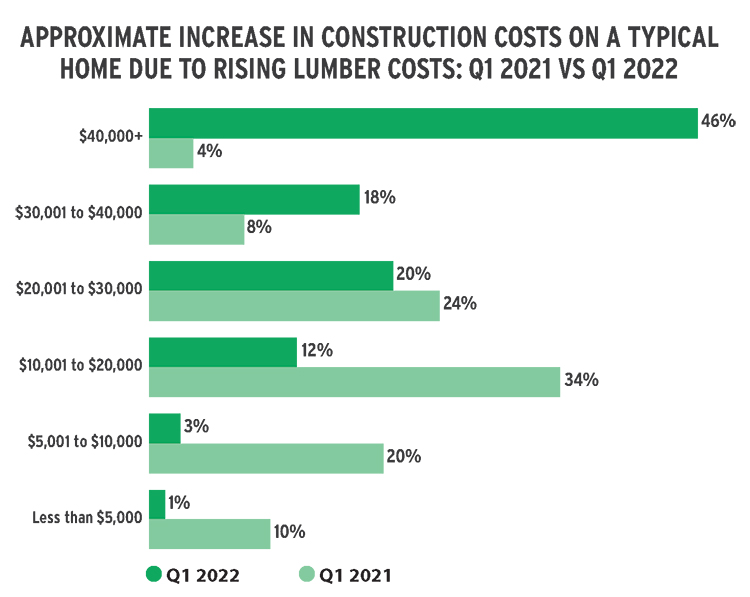

Special questions: Year-over-year trends

Year-over-year, the average increase in construction costs on a typical home due to rising lumber costs has doubled. Combining lumber and other material price increases, the national average construction cost increase for a 2,475-sq.-ft. home is up $80,000 compared to prior to the pandemic, half of which can be attributed to high lumber prices.

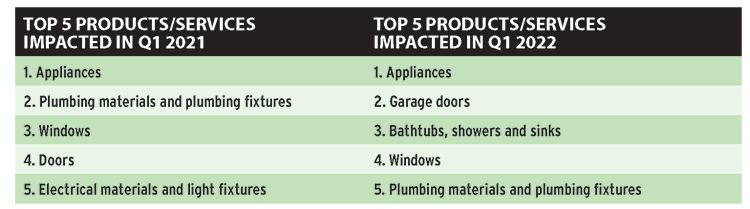

The COVID-19 pandemic has negatively impacted numerous aspects of the supply chain. Since Q1 2021, appliances have continued to be the product most impacted by supply chain issues, but a long list of other products and services have also been impacted. These supply chain issues are resulting in significant delays in home completions as the national average delay is 10 weeks in Q1 2022, up from six weeks since Q1 2021.

CHBA continues to support members by advocating for increased housing supply and addressing supply chain issues across the country. The full HMI results for each quarter can be found at chba.ca/hmi.