By Evan Andrade, CHBA Economist

So far through 2023, headline housing starts using seasonally adjusted rates have been stronger than anticipated – under much higher interest rates. However, data from the Canada Mortgage and Housing Corporation (CMHC) shows that housing starts for the year to date (to October) in Canadian centres with a population of more than 10,000 people is down seven per cent compared to last year. Looking into the breakdown, this has been driven by the 28 per cent drop in single-detached housing starts across the country.

The drop in year-to-date housing starts relative to last year reflects CHBA’s Housing Market Index (HMI), though is somewhat muted compared to the dire industry sentiment. However, the extremely low builder sentiment in the HMI is indeed reflective of the drop in single-detached starts. The HMI readings for single- and multi-family builders, CHBA’s in-house measure of builder sentiment on selling conditions, plummeted throughout 2022 and reached a record low in the fourth quarter of 2022. Throughout 2023, HMI readings have remained unambiguously negative with respect to builders’ opinions on selling conditions. Five consecutive quarters where both HMIs expressed downbeat builder sentiment implies a downtrend in national housing starts. So far, multi-family housing starts have performed above expectations but for reasons related to how quickly financial conditions changed.

What’s really happening

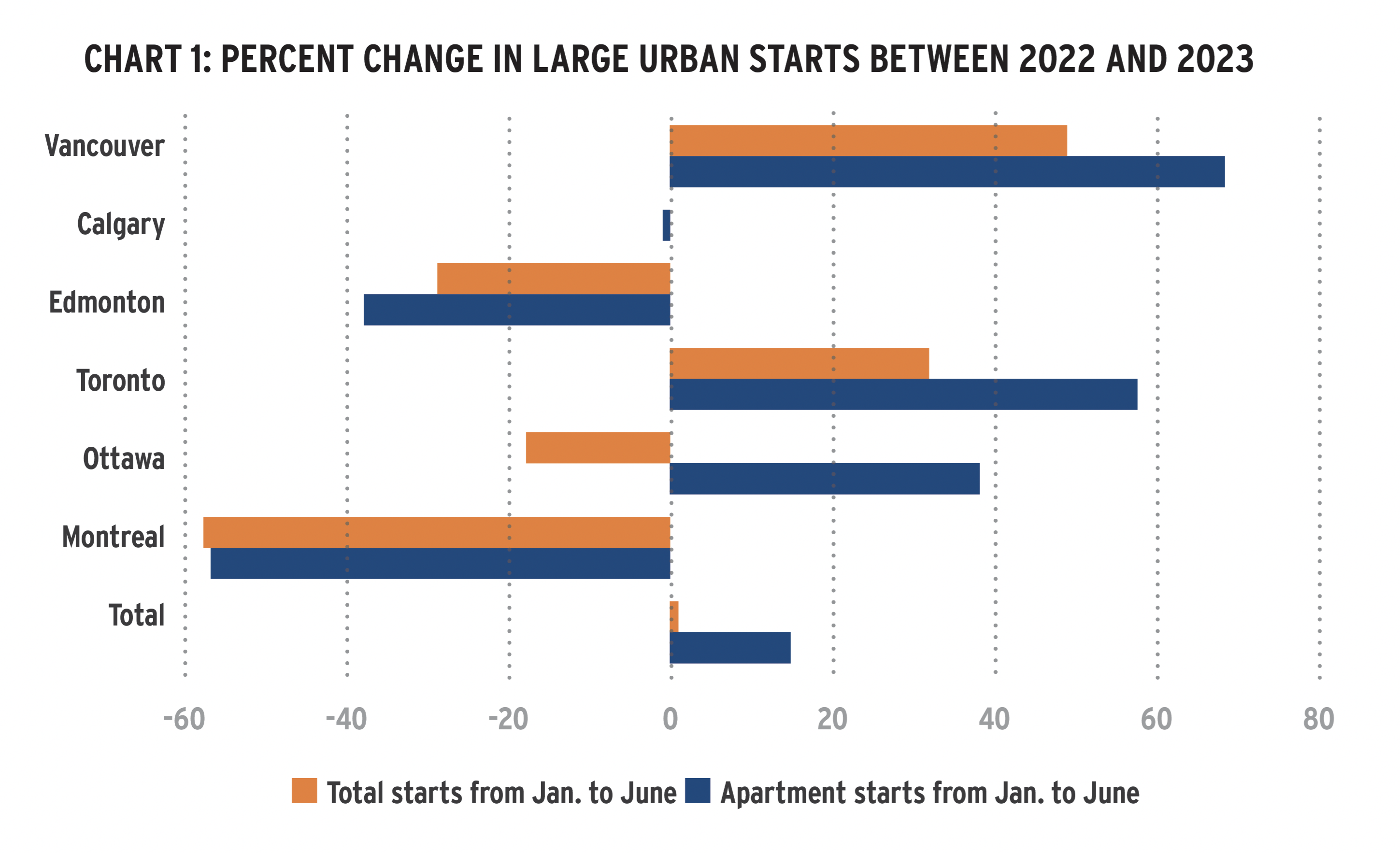

Digging below the headline, housing starts numbers – which are especially better than looking at CMHC’s seasonally adjusted rates, which can be misleading – we find that apartment dwelling starts, concentrated in Canada’s largest cities, are what is providing support for the overall housing start numbers being more buoyant than expected. For example, Chart 1 uses data from Canada’s six largest cities over the first six months of the year. Starts in apartment dwellings were up 68 per cent over the same period in 2022 in Vancouver, up 58 per cent in Toronto, and up 38 per cent in Ottawa. Across all dwelling types in cities such as Calgary, Edmonton and Montreal, starts were down and offset the large gains seen in the Toronto and Vancouver apartment starts. This can be explained by the longer pre-construction timelines of highrise condominium towers that would have been committed to in 2022 or even earlier, when builders had better lending conditions and still ample demand. As these prior project commitments work through monthly tallies of new housing starts, we expect total housing starts to begin trending downward more severely.

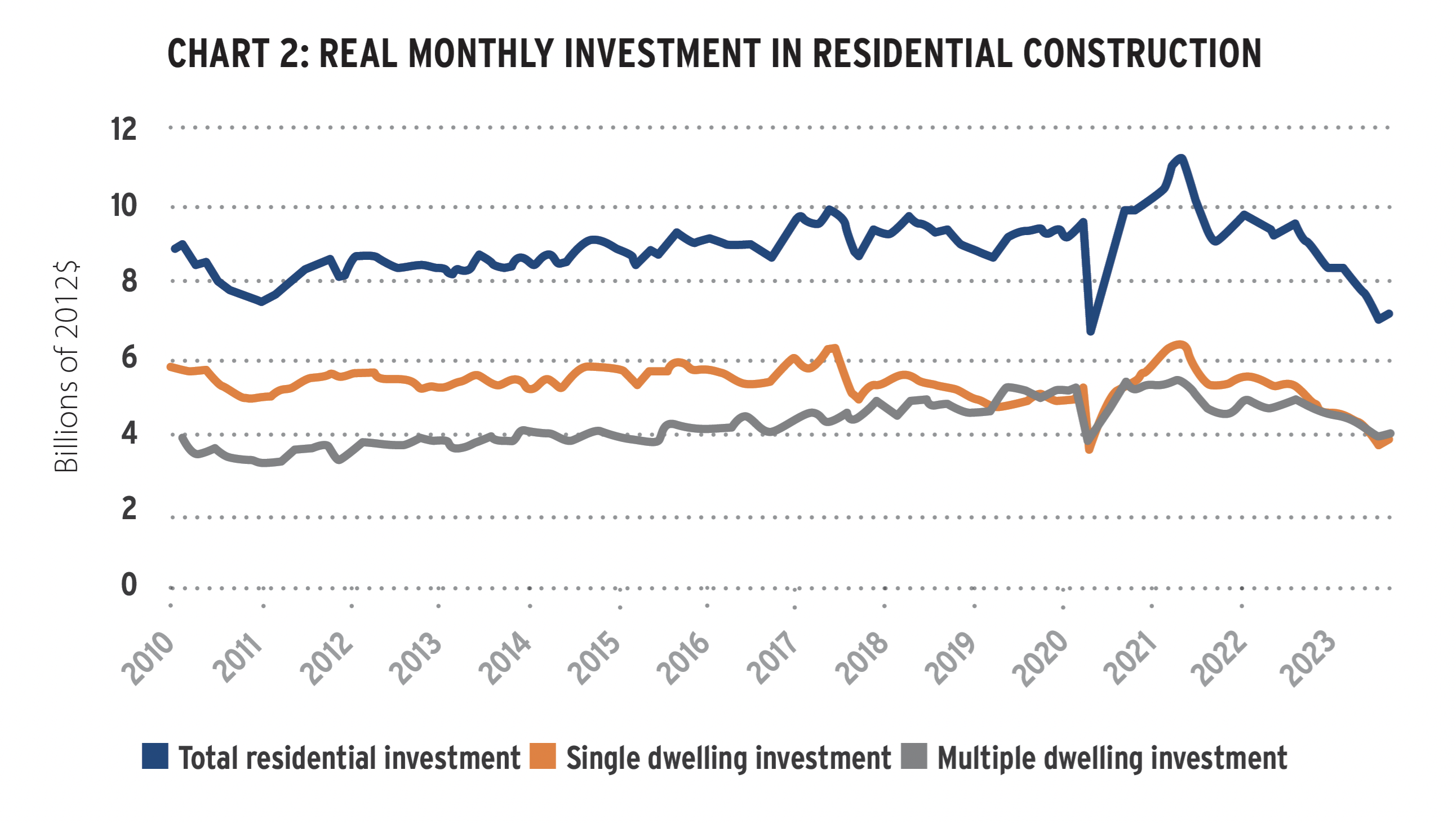

Housing starts are only part of the story surrounding the challenges that home construction is facing, as homes still need to be completed in a timely manner. Home construction activity is measured through real investment in building construction. This is an estimate of the value of the work done on new homes, as well as renovations, by using building permits, starts and completions data. This estimate of investment is converted into “real” terms by using the Building Construction Price Index (BCPI) to account for price growth over time that contractors face. This converts the nominal investment to its value in 2012 dollars. Since the end of 2019, the BCPI has risen 56 per cent, reflecting the rapid growth in materials and trades wages. Chart 2 shows that historically stable level of real total residential investment has fallen precipitously since mid-2022 and has hovered around $6.4 billion per month through the third quarter of 2023. This is the lowest investment level seen since the data began in 2010 – excluding the pandemic’s onset in April 2020. This is particularly concerning despite the steady overall housing starts we have seen so far this year.

The drop in real home construction investment underscores that home builders and renovators are facing challenges that are slow to improve. While it is true that slowing homebuyer demand is influencing builders to step back, we know that total housing starts have yet to fully reflect this slowdown. Like homebuyers, high interest rates restrict builders’ access to capital and increase the carrying cost of the debt they already have. This causes them to be more risk adverse about both future and current projects underway. CHBA’s latest HMI survey found that as a result of high interest rates, 65 per cent of builders have built fewer units and 37 per cent have canceled projects. This means that scaling back the size of developments is currently commonplace. Furthermore, builders continue to face challenges with accessing trades. The HMI found that 46 per cent of builders characterized access to trades as difficult, while 40 per cent also stated that trades access is a significant source of construction delays. While the circumstances of individual builders still vary greatly, difficulties maintaining timely access to the required labour is a challenge felt by builders from coast to coast.

Stimulating private sector home construction, through broad changes in government policy, is the only option Canada has to improve the demand-supply balance of housing markets across the country. If no changes are made, Canada will continue to see housing starts far below what is required, resulting a widening housing supply gap and a continuation of unaffordable housing. CHBA continues to advocate for the end to interest rate hikes and for housing policies across all levels of government to work in unison to support more housing supply. It is imperative that we reverse the downtrend residential construction activity and start making sustainable progress towards the government’s own target of building 5.8 million homes by 2030.