By Myha Truong-Regan, Head of Climate Research, RBC Climate Action Institute

While towering steel-and-concrete structures once symbolized economic growth, they are now emblematic of the climate challenge that needs to be scaled.

The extensive use of carbon-intensive cement, steel and aluminum in buildings has made it the third most emissions generating sector in Canada, accounting for 92 MT of CO2e, or 13 per cent of all emissions in 2022. Rising populations and a rush to develop multi-storey concrete buildings to address a housing supply crisis could make it harder to rein in emissions.

Canada can tap into its rich forestry resources to create a global market for large beams, panels and posts made of engineered wood, that can potentially replace concrete and steel or dramatically cut their use – and their associated emissions.

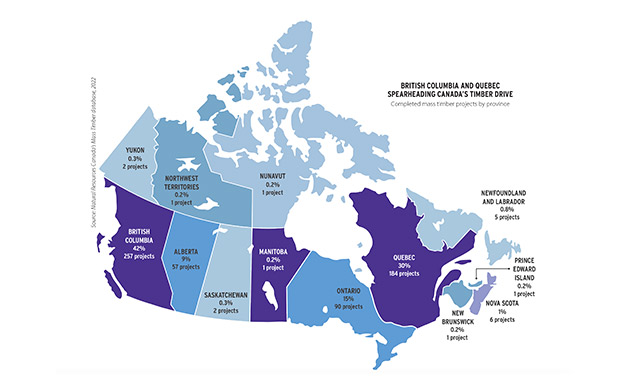

Change is already on the way. The rise of mass timber structures dotting Canada – 661 completed and growing – suggests we may be on the cusp of the next wave of sustainable buildings: Made with low-carbon mass timber and assembled like an Ikea wardrobe to help bring down emissions.

The 9MT emissions imperative

Concrete and steel’s emissions profile is six and five times greater than wood, respectively. Within the context of buildings and embodied emissions, concrete, steel and aluminum account for six per cent of Canada’s total emissions or 41 MT of greenhouse gas emissions, in 2022.

In multi-storey buildings, the floor system accounts for 50 per cent of a building’s embodied emissions that reside in materials that are considered especially challenging to decarbonize. Given the emissions profile of a building’s floor system, much of current decarbonization efforts have focused on this structural building element.

Multi-storey buildings constructed with a mass timber floor system can reduce their average emissions by 27 per cent for the floor system, and 12 to 25 per cent for the entire building structure, according to builders with extensive experience working with mass timber.

Indeed, the sector could cut 5.5 MT in emissions by 2030 if a third of all new apartments and condos and all new office towers, in major urban centres, were constructed using mass timber.

Emissions could decline a further 3 MT if all future apartments and condos were constructed using a mass timber floor system and domestic manufacturing capacity was not a constraining factor.

These emission savings demonstrate that small efforts, such as changing one element of a building’s structure, can lead to significant emissions savings, even though the size of the gains may pale in comparison to other purely technology-based solutions, such as heat pumps or electric vehicles.

Canada’s opportunity to dominate global mass timber market

Mass timber accounted for one per cent of all building construction materials in North America last year. The global mass timber market reached $1.6 billion in 2022 and is forecast to rise to $1.9 billion this year. The market is estimated to reach $4.9 billion by 2030 if global demand continues to grow at an annual rate of 14.5 per cent.

Canada’s share of the global mass timber market is $379 million in 2023. And it’s growing, with an additional $649 million expected to be added to the country’s economic output from the production of mass timber, under a scenario where there’s no new manufacturing capacity by 2030. Increased production capacity and efforts by Canada to capture 25 per cent of the global mass timber market could see economic output surpass $1.2 billion by 2030.

We expect the sector’s job growth to triple by 2030, to a high of 12,150 jobs across manufacturing, technology, forestry, design and engineering, if future demand materializes. Some of these jobs are anticipated to flow to Indigenous peoples as the employment catchment areas of logging sites, sawmills and mass timber manufacturing facilities often encompass their communities.

Barriers to Canada’s mass timber and climate ambitions

The rising number of mass timber projects underway in Canada is a testament to the building sector’s green ambitions. But fundamental challenges are preventing market participants from raising their ambitions at a pace necessary to reach Canada’s climate goals.

Insurance underwriting has emerged as the most difficult challenge for both building construction and occupancy insurance. Presently, each building requires a bespoke policy, which significantly adds to a project’s final cost, and is ultimately passed down to the end buyer.

Construction insurance premiums for a mass timber building can be up to 10 times the costs of a similar building constructed with steel and concrete. This layer of cost erodes the competitiveness of buildings featuring mass timber and hampers its widespread use in residential, commercial and institutional buildings.

Exacerbating the situation is the small and niche market for mass timber. The lack of actuarial data has meant that insurance companies typically insure mass timber buildings to the closest approximate building structure archetype – a wooden frame house constructed with two-by-four lumber.

A second structural issue is a mismatch between the location of mass timber production and demand for the material.

Some industry estimates suggest that 62 per cent of capacity and 22 per cent of demand is concentrated in western Canada, but 78 per cent of demand and 38 per cent of capacity is concentrated in eastern Canada.

One of the biggest impediments for manufacturers in scaling their operations is the cost of acquiring specialized mass timber machinery and technology, which is produced by only a handful of European-based manufacturers.

High cost of manufacturing equipment is also preventing new players from entering the mass timber business. The capital required to set up a manufacturing facility, with 50,000 m2 capacity, is estimated to cost $200 million, with the bulk of the costs attributable to machinery.

Canada’s sawmills are also dominated by players that produce “dimension lumber,” rather than mass timber “feedstock,” leading to shortages of the building material.

Recommendations

Canada has an opportunity to play a leading role in the global mass timber movement if it adopts the following recommendations:

Standardize insurance underwriting to lower costs. Standardizing insurance fire risks for mass timber buildings, during building construction and occupancy, will lower insurance premiums and overall costs for builders and building owners.

Continue funding capital expenditure grants. Federal and provincial grants have played a pivotal role in lowering machinery costs and enabling additional manufacturing capacity, either from existing manufacturers or new entrants. Continuing these programs would ensure supply can keep pace with double digit growth in domestic and international demand.