By Evan Andrade, CHBA Economist

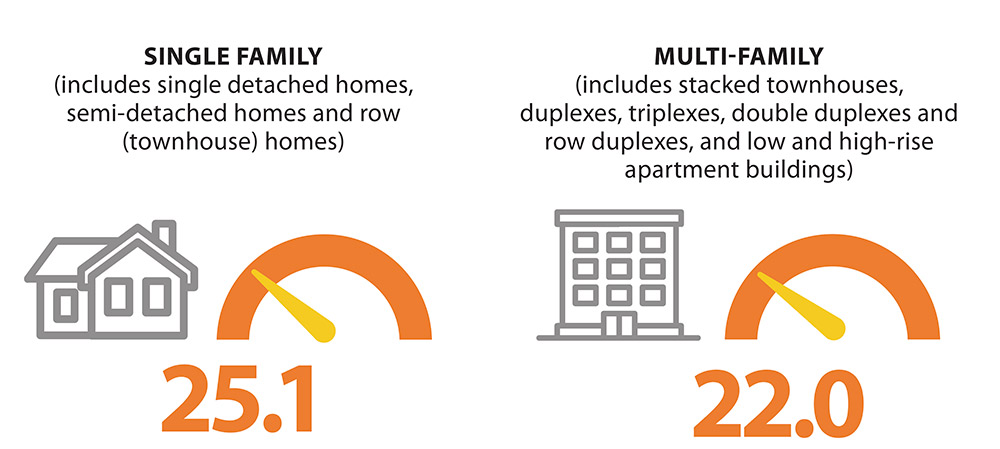

Builder confidence in sales conditions soured further in the final months of 2024 as pessimistic views about current sales and expected future sales broadened among builders and developers nationwide. CHBA’s single-family Housing Market Index (HMI), which covers singles, semi-detached and row homes, was 25.1 and just marginally above its record low reading of 24.6 in the last quarter of 2023. The multi-family HMI, which covers apartments, multiplexes and stacked condos, reached a record low of 22.0. In both the case of the single- and the multi-family index, builder sentiment worsened progressively throughout the year.

Bound between a score of 0 and 100, the HMI reflects the builder sentiment towards local housing market conditions. An HMI score of 50 would depict market conditions where an equal proportion of survey panelists were optimistic and pessimistic in their responses to key questions about sales. HMI scores that fall further away from 50 indicate a greater breadth of pessimism and provides a strong indication of downward pressure on future housing starts slated for freehold ownership or condominium strata ownership.

Disparate sales conditions

Regional differences in sales conditions have grown more disparate over the past two years – including the fourth quarter of 2024. Ontario’s and British Columbia’s HMI readings continue to fall, driving the overall decline in the national index. Results from Atlantic Canada have held around neutral, while sales conditions in the Prairie Provinces have largely risen back to reflect broader optimism. The regional HMI trends over the past eight quarters largely reflect longstanding affordability conditions, as the shock of high interest rates subsided.

Unfortunately, the Bank of Canada’s lowering of short-term interest rates have not been able to turn around these affordability challenges for the majority of builders. This stems from fixed-rate mortgages rates falling at half the rate as the Bank of Canada’s short-term policy rate, as adjustments move more with longer-term five- and 10-year bond yields and competition among lenders, versus the Bank’s overnight lending rate.

When builders were asked if the latest interest rate cut improved their outlook for sales over the next six months, 34 per cent of builders stated that it had not and that interest rates would need to fall further before they raised their outlook. A further 31 per cent of builders stated more time is needed to assess the impact that the December rate adjustment will have on their sales.

No fresh new start in 2025

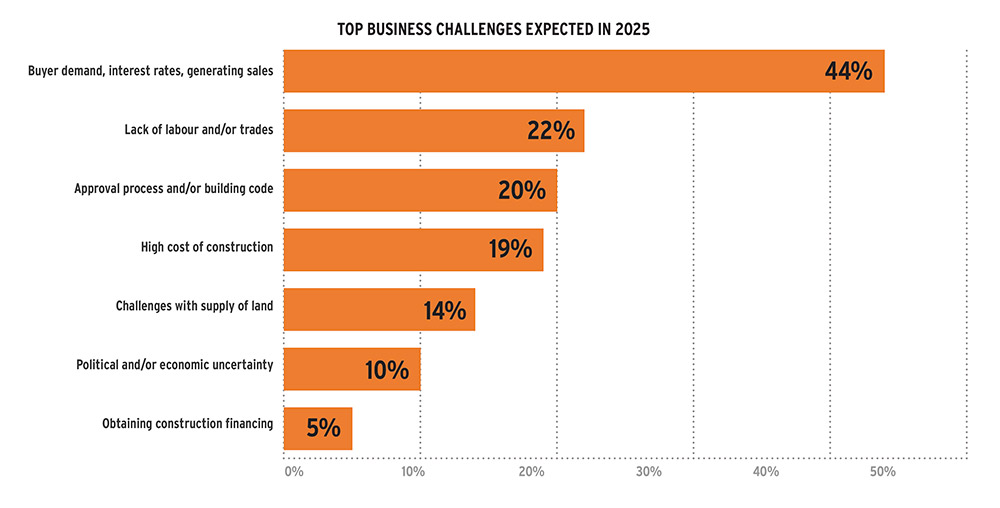

U.S. tariffs and Canadian counter tariffs have been the dominant threat to begin 2025. When the last HMI survey asked builders what their top challenge for the year will be, 44 per cent said getting enough buyers and generating sales. A further 19 per cent stated that it will be managing their construction costs. Both these challenges would be exacerbated by tariffs. The uncertainty alone is damaging to many industries, including residential construction. Builders need to know what their costs will be between when they make a sale. For many, if uncertainty about the project’s viability becomes too great, pausing or cancelling the project is the likely outcome.

This reality is impacting both sides of the border. The NAHB, CHBA’s counterpart in the US, conducts a similar HMI, and they saw the largest one month drop in nearly three years because of the tariff threat on materials that come from Canada, Mexico and China.

Given the scale of the proposed tariffs, and supply chains between the USA and Canada that have become more integrated over time, it is difficult to project the rise in construction costs that would be expected. In its assessment of the list of projects within the first phase of counter tariffs, CHBA assessed that builders could see the most disruption in the supply and cost of large appliances. Policymakers and officials have guided that additional U.S. tariff retaliation will be designed to minimize the impact on building material supply, and CHBA continues to engage with the government on this issue. However, given the integration of supply chains, broad U.S. tariffs will inevitably be passed onto products that must cross the border as they move through the manufacturing and supply chain, making it practically impossible to remain entirely unscathed.

Uncertainty of tariffs

Despite not knowing the final implementation of tariffs at the time of writing, their most considerable impact in Canada would be the further erosion of homebuying activity. Job losses resulting from near- and long-term supply chain shake-ups would be devastating to local and national economies. Strong labour market conditions and a feeling of job security are fundamental supports to both existing and new home sales. Just like builders, buyers need certainty before they commit to a home purchase. Measures of Canadian consumer confidence fell considerably in February, ahead of the potential March 3 and March 12 implementation dates. These results were pulled down by Canadians’ views held about the future of the Canadian economy.

CHBA continues to monitor and meet with government officials across all involved ministries regarding tariffs and the state of new home sales, and the HMI continues to be of great interested to them and the Bank of Canada, with whom CHBA meets regularly to inform the Bank’s rate decisions. If you are a builder not yet participating, please consider joining the HMI panel to provide input, so that your voice can be heard at the federal level – it only takes 10 minutes each quarter. Please reach out to signal your interest by emailing hmi@chba.ca.