By Evan Andrade, CHBA Economist

One of CHBA’s objectives is to push for improved data collection and publication related to new home construction. With the high-level policy target of doubling housing starts over the next 10 years, much of the data needed to track progress towards this target is simply not available. For example, the number of new housing starts that utilize some form of factory construction product would be helpful in monitoring the government’s effectiveness in promoting and reducing the barriers to modular construction.

This article explores several sources of factory-built construction data, and what we can learn from them.

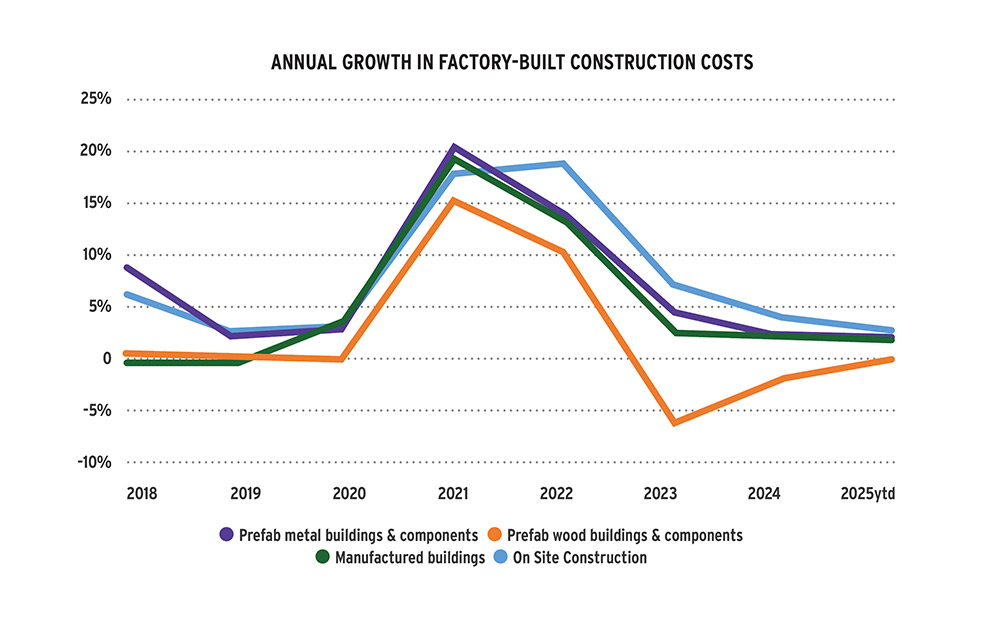

Hard costs of modular construction compared to on-site (stick-built)

Statistics Canada tracks the factory gate price growth of prefabricated buildings. This is measured as a component of their Industrial Product Price Index (IPPI). We see that the annual year-over-year cost growth between 2018 until the third quarter of 2025 is highly correlated between modular buildings and on-site construction. In both instances, the growth rate of costs have slowed, but continue to compound on the double-digit cost growth seen over 2021 and again in 2022. This strong correlation helps support the view that while modular and other factory-built construction methods offer many benefits over on-site construction, especially speed of construction, hard cost savings is currently not universally true.

Accessory Dwelling Units potential growth area for factory-built construction

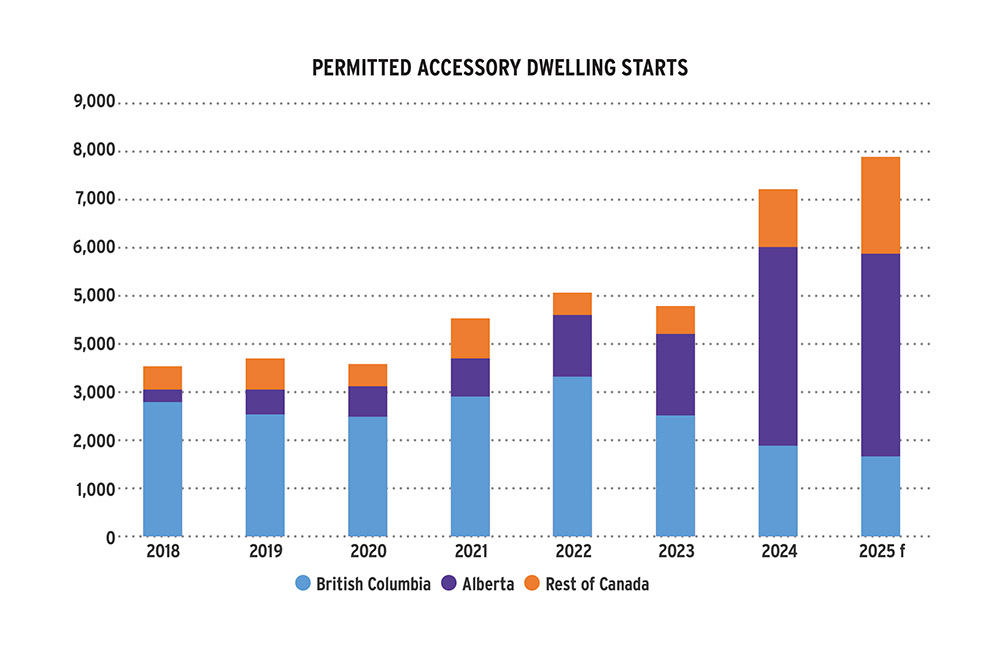

In discussions with the data team at CMHC, CHBA continues to stress that the “apartment and other” category (which includes everything from ADUs to stacked townhomes to highrise residential towers) is antiquated and does not allow measurement of important middle density housing. Listening to this feedback, CMHC is now reporting quarterly on accessory dwelling unit (ADU) starts. While more breakdown of the category is needed, getting this data on separate accessory suite options like laneway suites, garden suites and carriage homes is very helpful, as they are a great application for factory-built methods. Clients often hire a renovator to build their ADU. This means that demand for factory-built products will likely increase from both site builders and renovators, who can still do the site-work, but save time and limit disruption for buyers through factory-built solutions.

Annual permitted ADU starts make up a small number of overall housing starts right now. However, starts over the past five years show how they are gaining popularity – particularly in Alberta and British Columbia. Starts in 2025 are expected to reach more than 8,000 units. However, the chart below reinforces the reality that if people are not buying new homes, the industry is not producing them. As sales conditions in BC slowed, as measured by the HMI, the number of ADU starts slowed. Alberta’s healthier market has allowed them to produce more than 4,000 units in back-to-back years. This helps illustrate the challenges of managing overhead in producing a product that is subject to large swings in demand.

Trade data shows Canadian prefabricated housing sector making gains

Looking at annual trade data also shows progress for Canada’s prefabricated housing sector. Over the past decade, Canada gradually reduced its annual prefabricated building trade deficit with the United States of more than $300 million in 2014 to a small trade surplus of $32 million last year. This pattern is consistent with prefabricated construction in Canada growing in terms of competitiveness with the U.S. While high transportation costs may prevent greater Canadian competitiveness in overseas markets, it is important to see that Canada’s capabilities in prefabricated construction are comparable to our neighbours to the south.

Builders using or considering factory-built construction methods

Each year since 2023, CHBA’s Housing Market Index survey asks builders a series of questions related to their use of factory-built construction. The intent is to get data on how, why and how fast builders are incorporating modular into their businesses.

In 2023 and 2024, builders were asked if their business currently makes use of modular housing, manufactured homes, panelized components or pre-engineered packages. Both years, use of panelized components came out on top as the most prevalent factory construction method among builders, with 26 per cent of builders using them. Just seven per cent said they use pre-engineered packages and five per cent of builders reported using modular construction.

In 2025, CHBA asked builders who do not currently utilize factory construction products which they would be most likely to consider over the next three years. The result: 59 per cent are giving some level of consideration to using panelized components, 55 per cent would consider pre-engineered packages, and 13 per cent are open to using either modular or manufactured homes. This level of consideration has not changed much since we began collecting data, which indicates that while there is room for broader adoption of modular construction, there are clearly barriers to doing so.

Like builders that are currently using some form of factory construction, these prospective builders are far more likely to partner with an existing third-party factory than investing in an in-house factory as their first foray into factory construction.