By Evan Andrade, CHBA Economist

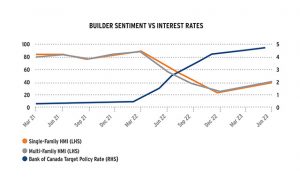

With the Bank of Canada leaving its overnight policy rate unchanged between Jan. 25 and June 7 and the traditional spring busy season for home purchases, CHBA’s Single- and Multi-Family Housing Market Indexes (HMIs) rose slightly again in the second quarter. Despite the rise, both HMI readings still reflect downbeat sentiment from homebuilder and developer members. The HMI’s strong correlation with future housing starts indicates that 2023 starts will fall well below levels seen 2021 and 2022. Given the target of doubling housing starts over the decade, failing to progress on this goal even in one year puts considerable pressure on housing starts targets in subsequent years.

CHBA’s Housing Market Index

The pulse of Canada’s residential construction industry.

CHBA’s Housing Market Index (HMI) provides a leading indicator of housing starts approximately six months in advance and ahead of building permit values. As an index, which is bound between zero and 100, it represents the balance of homebuilder opinions about both current and expected future selling conditions. Values below (above) 50 represents a balance of opinions that are more negative (positive). Please see chba.ca/hmi for our full survey results.

The evolution of an ongoing industry pain point

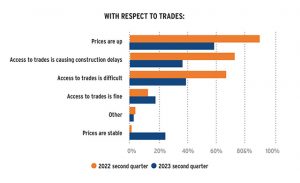

In the HMI survey, CHBA also polls builder members on special questions related to current industry issues. Some of these questions are repeated over several quarters to assess the dynamics and prevalence of these issues over time. As of June, when the second quarter survey was conducted, it was found that building material and labour issues had improved somewhat but remain a challenge for the industry.

In the latest survey, 47 per cent of builders found it easier to access trades than in the recent past – though that’s due to the slowdown in activity, which can hardly be considered a positive. Relative to the second quarter of last year, the prevalence of pressure on construction stemming from trades shortages is down. Yet the proportion of builders reporting difficulties with trades still far outweighs those that are not. Even as 25 per cent reported trades prices are stable, builders also reported that the average costs of trades have increased 28 per cent since pre-pandemic times.

These responses show that the extent of construction labour constraints are currently being masked by the slowing effects of restrictive interest rates. It also illustrates that there is no single silver bullet that will solve the challenge of supplying enough new homes over the long term. Coordinated policy from all levels of government is needed to address rising construction costs, underlying labour shortages, and to offset current financing conditions. In support, CHBA is currently developing a sector transition strategy to outline policies that are needed if we’re to achieve Canada’s goal of building 5.8 million homes in the next 10 years.

The outlook for new housing supply in Canada

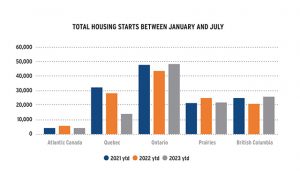

Through the first half of 2023, January to June, Canadian housing starts have totaled 96,500. This is down about seven per cent and 13 per cent, respectively, from the starts seen over the same period in 2022 and 2021. In Ontario and BC, where housing unaffordability is most acute, market pressure and some political urgency has buoyed new starts around the levels seen in 2021.

While the decline in national year-to-date housing starts may seem moderate, it underscores the lack of progress in improving affordability by increasing new housing supply. In addition, 2023 housing starts numbers are likely being supported by projects approved and committed to in 2022 or prior, when builder sentiment was very positive. In Q2 of this year, 22 per cent of builders say they have cancelled projects and 67 per cent say they are building fewer units. Obviously, fewer projects in a builder’s pipeline will translate into fewer housing starts in the near future.

There is also evidence that demand from homebuyers will slow further, putting further downward pressure on near-term starts as builders adjust accordingly. While sectors such as home construction show the effects of changes to interest rates the quickest, historically it has taken 18 to 24 months for interest rate changes from the Bank of Canada to fully filter into the broader economy. In the four quarters of available data since the Bank began raising interest rates, quarterly GDP growth has been strong in all but one, which is why they continued raising interest rates. July projections from the Bank of Canada peg real GDP growth for the remainder of 2023 and all of 2024 to average a more modest one per cent, which hopefully will have the desired effect of lowering inflation. These intended weaker economic conditions, in combination with high borrowing costs, will likely maintain low builder confidence in embarking on in embarking on new projects.

It is clear from the chart below (which reflected builder sentiment after the interest rate increase in June but prior to the one in July 2023) that higher interest rates and tighter financing conditions eroded builder sentiment throughout 2022. Through the first half of 2023, with more gradual interest rate hikes and homebuyers returning to the market – monthly increases in existing home sales supports this – homebuilder sentiment has pulled up from its fourth quarter 2022 low. Despite this moderate rise, a continuation of downbeat builder sentiment surrounding selling conditions highlights the immense barriers to achieving greater housing supply. The results of CHBA’s HMI, analyzed in tandem with overall economic projections, indicate a slowdown in home construction in the quarters ahead.