By Evan Andrade, CHBA Economist

With many media headlines focused on housing affordability and the increased political action to incent more housing supply, the health of the renovation services industry may not be receiving the attention it should be.

Canada’s existing housing stock consists of 16.7 million homes, including 10.7 million ground-oriented units. That’s an enormous number of dwellings requiring updates, retrofits and general repairs. With the rise in multi-generational housing arrangements, secondary suites and accessory dwelling units (ADUs), renovators clearly also play a role in expanding the housing stock.

Economic contributor

Renovation and repair services are a vital contributor to Canada’s economy, representing $105.5 billion in nominal spending in 2023. CHBA estimates that this translated into 526 thousand jobs supported directly and indirectly and that those jobs collectively paid $36.9 billion in wages across Canadian communities.

So far in 2024, nominal renovation investment (excluding repair), which is the amount of money before factoring in inflation, is trending even stronger than 2023. Between January and August this year, investment totalled nearly $59 billion compared to $52.6 billion last year. This increase in investment was driven by record spending on multi-family building renovations, while spending on single-family renovations remained unchanged. Monthly renovation investment has reached new record highs in each of the last three months of available data (which Statistics Canada provides starting in 2017) as a result of strong multi-unit investment. The increase is led by Quebec and Ontario, though most other provinces have also seen an increase in multi-unit renovation investment so far this year.

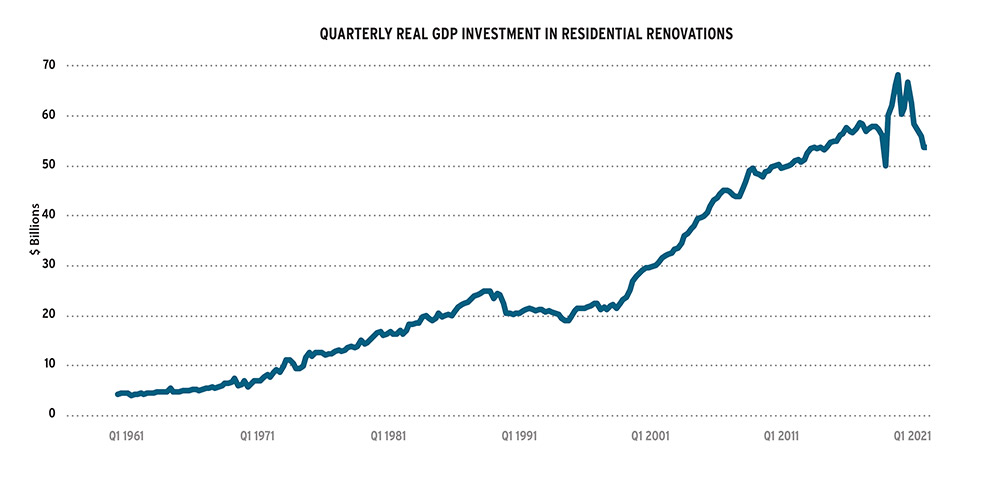

Surprisingly, this nominal investment increase has not translated into real GDP expenditure for renovations in the first two quarters of 2024. Real GDP tracks the “volume” of work by converting nominal values using prices recorded in reference year – 2017 in this case. The chart on the opposite page shows historical real GDP output of the renovation-industry in Canada. Since the 1960s, real renovation output has been fairly stable and consistent – save for the 1990s. In general, real output has grown organically with a larger housing stock and a wealthier population. Although the term may be overused, it is fair to say that the volatility in real output since 2020 is unprecedented. As quickly as the investment rose to its peak level in 2021, it evaporated. This decline has continued in the first two quarters of 2024, despite the increase in nominal investment. The second quarter real GDP for renovations stood at $50.7 billion annualized. If excluding the start of the pandemic, this is a low volume of work last seen in 2013.

What could be causing this difference between nominal and real output?

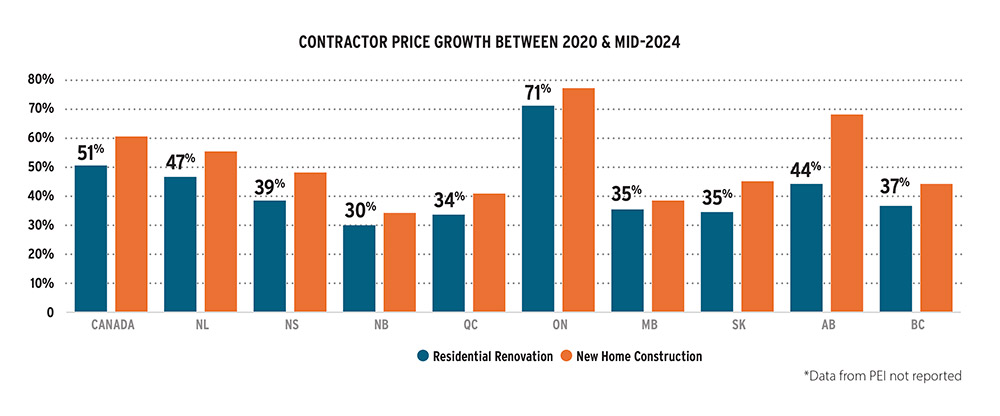

One reason is that materials and labour costs are rising in all parts of the country, so expenditures are up but volume is down. In October, Statistics Canada released its new Residential Renovation Price Index (RRPI) – which CHBA provided input on last year – that records average pre-tax prices charged by renovator contractors over time. The index covers prices charged within 15 cities across Canada and averages across 37 different types of home improvement projects. The RRPI has risen more than 50 per cent nationally since the start of 2020. The chart above shows how renovations and new home construction are facing comparable rises in costs in every province except for Alberta.

Prevalence of cash businesses

Rising costs also lead to a second potential reason, which is that there is likely an unfortunate rise in cash-based work. While nominal investment is derived in part from permit issuance, real GDP likely incorporates other data sources of consumer and business spending. Like the ongoing poor selling conditions for new homes, few households will go ahead with major renovations as the quotes reach above the consumer’s budget. Under pressure to maintain a flow of incoming work, more renovators may be feeling pressure to offer cash prices to compete with fly-by-night contractors. These cash jobs are likely not being recorded in GDP.

The prevalence of cash businesses, and the unfair advantage they have over legitimate contractors, is one of the reasons why CHBA has renewed its efforts to promote the Association’s consumer-facing RenoMark program. This distinction allows homeowners to easily identify trusted CHBA members that have proven they provide a superior level of service and care.

But there is good news for the future. Real GDP output from renovations could rebound in the second half of 2024, given record investment in nominal terms. Projections from the Bank of Canada anticipate renovation activity to improve in 2025 and 2026, as the broader “housing” sector of the economy will contribute nearly a quarter of all economic growth in these two years. The Bank expects existing home prices to rise on average as their policy rate comes down from restrictive levels while other key barriers to new home supply remain. Both the lower cost to borrow and rising property values will be, in their view, conducive to broadly higher real renovation activity next year.

In December 2024, CHBA hosted a webinar specific to renovator members about the economic outlook for renovations in 2025. The presentation consists of key near-term opportunities to drive renovator business growth, a summary of CHBA’s federal advocacy that affects renovators, and future policy recommendations. The recording of this insightful webinar can be accessed by members at chba.ca/webinars.