By Evan Andrade, CHBA Economist

Reaffirmed last September, CMHC estimates that Canada needs 5.8 million new housing units by 2030 to restore nation-wide affordability. The numerous barriers holding back construction must be overcome to accommodate the pace of residential construction required to approach this target. CHBA’s Housing Market Index (HMI) aims to help achieve a healthier supply balance by assessing the pulse of homebuilders over time and capturing builder views on various current issues facing the industry. It uses similar methodology to the NAHB/Wells Fargo HMI for the US housing market, which has been conducted since 1985. CHBA’s HMI has garnered significant attention in Canada, with government decision makers, as was CHBA’s goal. For example, CHBA is meeting each quarter with the Bank of Canada to review the HMI quarterly results and provide insights on the issues and challenges facing the homebuilding industry.

By asking builders to give a simple rating of current sales conditions and expectations over the next six months, as well as the level of prospective buyer traffic, the HMI provides a strong leading indicator of where housing starts are headed over the next few quarters. CHBA then uses HMI results in its advocacy with government, pointing to

real data to illustrate what’s in store for housing starts.

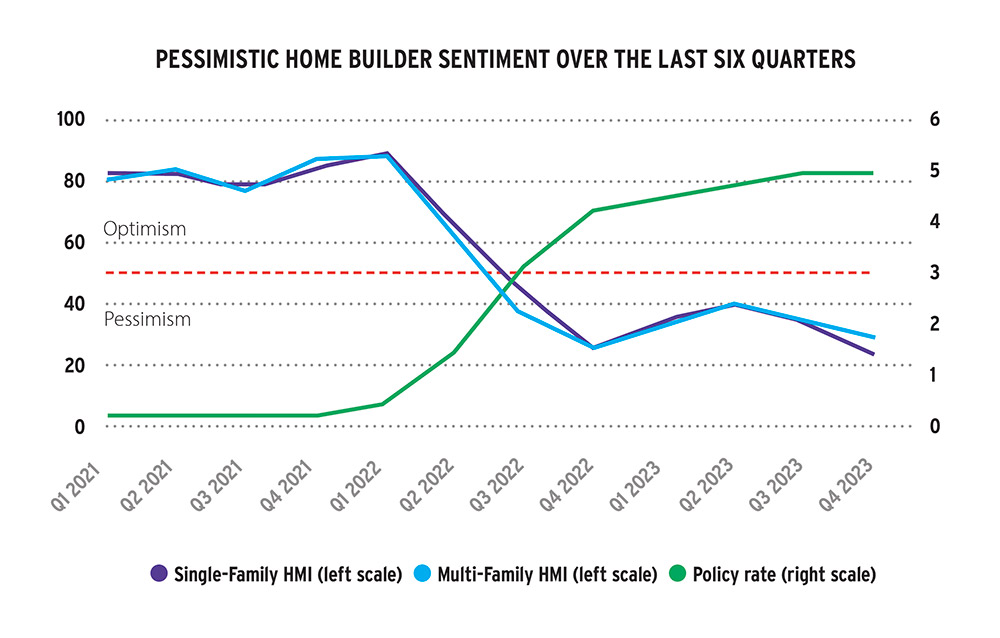

In the latest HMI, a large proportion of builders surveyed characterized the selling conditions as poor and their sales office traffic as weak relative to earlier quarters in 2023. Pessimism among builders was most acute in Ontario. As a result, the fourth quarter single-family HMI fell to its lowest level in its three-year history at 24.6, and the multi-family index came in at 29.1, which is only slightly above its all-time low. For interpretation, the index is bound between a score of zero and 100, with a score of 50 representing neutral sentiment where an equal proportion of builders are upbeat and downbeat about selling conditions. The further the HMI scores below 50, the wider the breadth of negative views about selling conditions.

Deterioration in sales and traffic conditions are a result of high interest rates shrinking the pool of qualified or interested buyers. In line with the Bank of Canada’s setting of monetary policy, average mortgage interest costs grew 28.4 per cent in 2023 over the previous year, according to the consumer price index. Far fewer prospective buyers can pass the OSFI-mandated stress test of an additional two percentage points above the contract rate. Within the multi-unit segment, the high servicing costs of financing also reduce the attractiveness for investor purchasers on a cashflow basis. Furthermore, beliefs about when the Bank of Canada will begin lowering rates are also pushing many would-be buyers to the sidelines as they try to time purchases for the best combination of home price and mortgage rate. Poor sales conditions translate into reduced builder incentive and cash flow for ongoing and future developments – lowering housing starts.

These results set up a challenging outlook for housing starts in 2024. With both single- and multi-family HMI readings in very pessimistic territory over the past six consecutive quarters and an expectation for economic growth for 2023 and 2024 to come in below two per cent, CHBA predicts annual housing starts in 2024 to decline – reverting closer to the long-term average. While the level of housing starts between 2021 to 2023 were historically strong, they continue to decline at a time when starts must urgently ramp up. In January 2024, seasonally adjusted housing starts fell 10 per cent from the month prior, from a 14-per-cent dip in urban multi-unit starts. Last year, multi-unit starts were buoyed by highrise condo starts in large urban areas, where development decisions to proceed were made prior to the rise in interest rates. Multi-unit starts are expected to be softer in 2024, more in line with sales conditions characterized by the HMI.

Looking beyond interest rates

In the latest HMI survey, 70 per cent of respondents stated that a pre-existing factor or factors had also contributed to their business starting construction on fewer homes in 2023. While these pain points are well known within the industry, it is still important to understand the scope of their impact during a period where sales are down, especially when explaining to policymakers how they affect new home construction. Nearly half of respondents stated that challenging municipal processes are reducing the level of starts. Not only does the persistent growth of development charges make it more expensive to build, lengthy permitting and approval timelines can also reduce the viability of a project. The rollout of the federal Housing Accelerator Fund could be a catalyst to improving the process holistically, however the benefits of this program will take further time to realize.

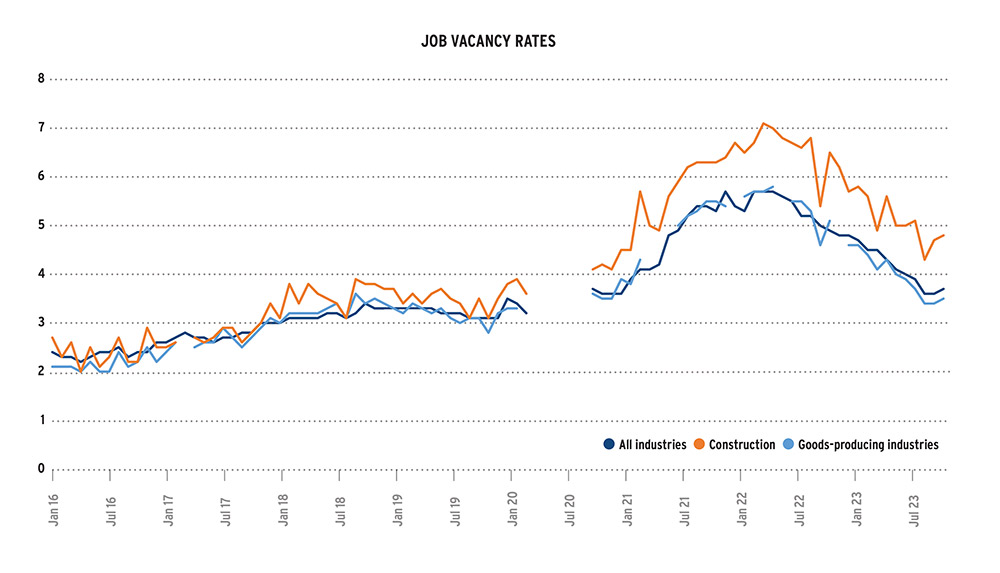

While reduced construction of single-family homes helped improve access to trades modestly, labour was still reported by 30 per cent of builders as a factor limiting housing starts in the current environment. Job vacancy rates tracked by Statistics Canada show that construction sector employers faced roughly the same prevalence of job vacancies as other sectors in the economy prior to the pandemic. Even though the job vacancy rate in construction has come down from its peak in 2022, the construction sector has consistently seen higher vacancy rates than other sectors in the post-pandemic era. Moreover, accordingly to BuildForce Canada, 22 per cent of the residential workforce is set to retire over the next decade, with 40 per cent aging to more than 55 years old. The status quo for labour supply is not adequate for new construction or renovation/retrofits. Deliberate policy changes, advocated by CHBA, for both domestic and international labour recruitment are required to alleviate these limitations over the coming years.

The Bank of Canada has begun incorporating CHBA’s HMI results into its due diligence process leading into its policy decisions. However, monetary policy affects the economy as a whole and alone cannot solve the housing supply challenge. CHBA uses the HMI findings to advocate on the importance of government housing policy reform at the municipal, provincial and federal levels. The aim of policy should be to offset the impacts of restrictive interest rates over the near-term and support the sustained scaling up of home construction capacity over the long term.