By Evan Andrade, CHBA Economist

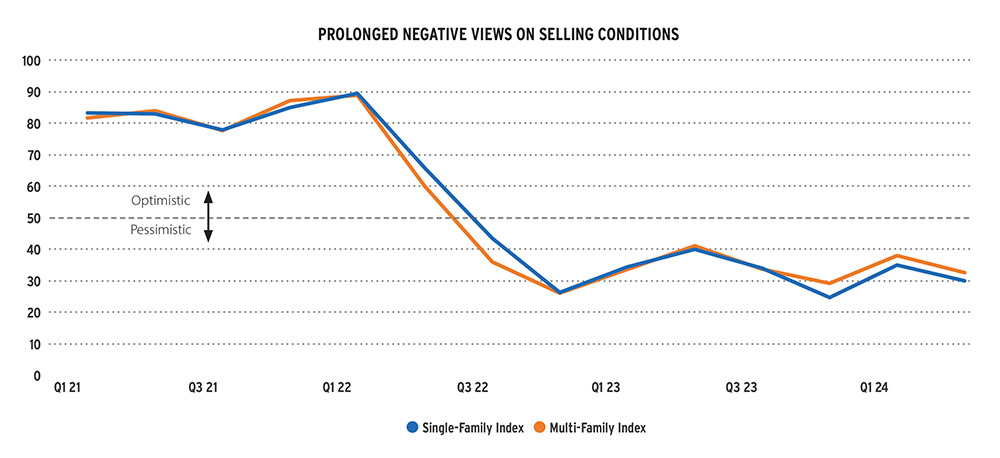

At the centre of solving Canada’s affordability crisis is getting more Canadian into new homes. To assist in tracking industry health ahead of housing starts, CHBA conducts its quarterly Housing Market Index (HMI) survey. The survey asks CHBA builder members for their views on selling conditions and reports sentiment as a score between zero and 100. The chart below shows the historical results of the single-family and multi-family index. Nationally, the results from the second quarter 2024 survey continued to show negative views on selling conditions for single- and multi-family homes. Sentiment was further negative than the results from the first quarter survey. This reflects another poor spring selling season, showing that the Bank of Canada’s policy rate reduction has not been meaningful enough to allow more buying activity.

This quarter, CHBA also provided insights on the regional results of the HMI, as stark trends have continued to widen between geographic regions since the end of 2022. The prairie provinces have seen a general uptrend in sentiment over the past year and a half, and their regional HMIs, while not stellar, are at least now higher than a value of 50. This is significant because it means the balance of builder views has shifted to being modestly positive with regards to sales. Atlantic Canada sentiment held steady around the neutral score of 50. Meanwhile, sentiment among Ontario builders is terrible, and British Columbia builders continued a steady downward trend. Both provinces’ HMI readings reached new lows in Q2 2024. Even weaker sales conditions continue to warn that starts slated for ownership in these provinces will continue to decline. The regional divergence is the differences in both the cost of housing and income prospects that factor into housing affordability. These are rooted in regional housing system structural factors that we are seeing reflected in the HMI survey indicating that we have moved beyond solely the impact of high interest rates – the compounded effect of high interest and high housing costs is drastically eroding sales.

Builder margins under pressure

Many people outside of the industry believe that builders and developers could and should reduce their selling prices to help improve sales. However, even under the poor selling conditions outlined by the HMI, there is a limit to how much builders can avoid raising selling prices over time – let alone reduce them. Cumulatively since 2020, new home selling prices have risen 19 per cent across urban areas and new condominium prices rose just 7.7 per cent, according to Statistics Canada (StatCan). Put another way, annual price growth over the past four years has averaged 4.8 per cent for ground-oriented homes and near zero growth on average for condominiums. This is far less than the gains seen in the existing housing market and the general inflation rate of consumer goods and services over the past several years.

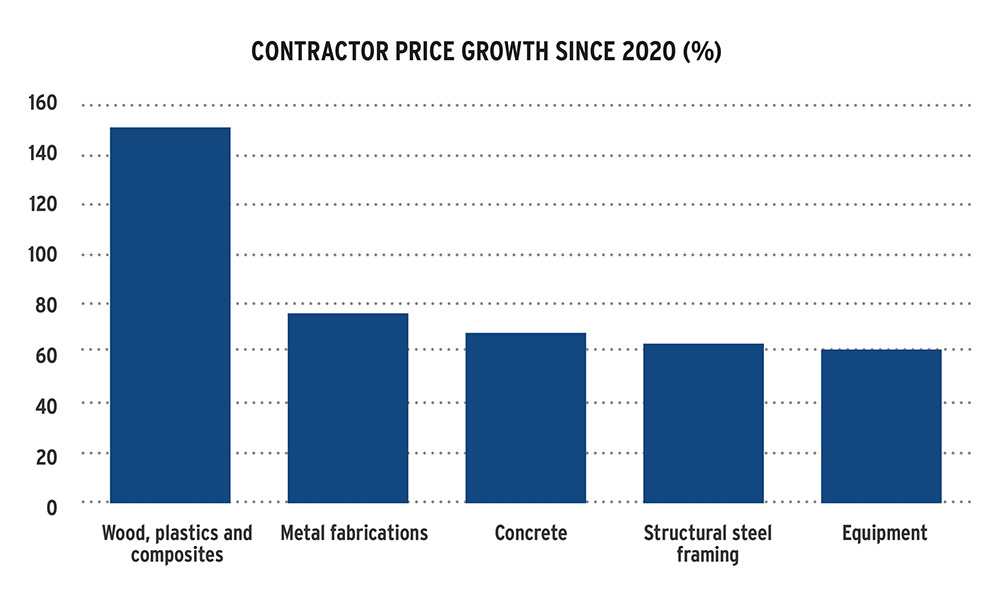

The rate of increase of construction costs a builder faces has been far outpacing selling price increases, according to StatCan’s Building Construction Price Index. Since 2020, the cost of ground-oriented construction is up 69 per cent and apartment construction cost is up 53 per cent. It is not niche or substitutable building products that are leading to these price gains either, it’s the main inputs that go into building homes. Chart 2 shows the remarkable 151-per-cent increase in the price of wood, plastics, and composite materials between the first quarter of 2020 and second quarter of 2024. Out of the 23 cost components that are tracked by the government agency, eight components report cumulative growth of more than 50 per cent.

While those within the industry understand well that higher costs have settled into the new normal, CHBA continues to raise awareness on costs through media to the public and to politicians. It is simply not possible to deliver housing and reduce selling prices further in this building environment. These are just the hard costs of construction and say nothing about the continued rise of the soft costs incurred during the preconstruction phase. Project viability is being hurt by the consistent rise in builder costs, while the buyer’s ability to qualify for adequately sized mortgages under the current underwriting rules has reached its limit. These are the issues that housing policy must be bold enough to address.

The role data has in home construction

In addition to providing frameworks and policy recommendations that will support greater supply of new housing, CHBA is also engaged in ways to improve housing market data. With regional building targets set and new policies that tie federal funding for infrastructure to meeting new home construction goals, it is important that our measurement of housing starts and construction improves. CHBA has had discussions with StatCan and CMHC requesting that housing starts numbers be broken out to provide a better picture of medium density housing. Currently, this is obscured with a catch all “apartments and other” category. CHBA has also strongly recommended that new federal funding for housing data be used to more closely monitor developments as they move through the phases of construction. As the old adage goes: “What gets measured can get managed.”

Of course, CHBA’s HMI is also an important, and forward-looking, data source for residential construction in Canada. It is being closely monitored by StatCan, the Bank of Canada, and other policy makers. The more HMI participants we have, the better we can inform government policy on your behalf, so if you are a builder interested in providing your input on sales conditions in areas you sell and build in, contact us at hmi@chba.ca.