By Susan Carter, Vice-President, marketing and communications, Sagen

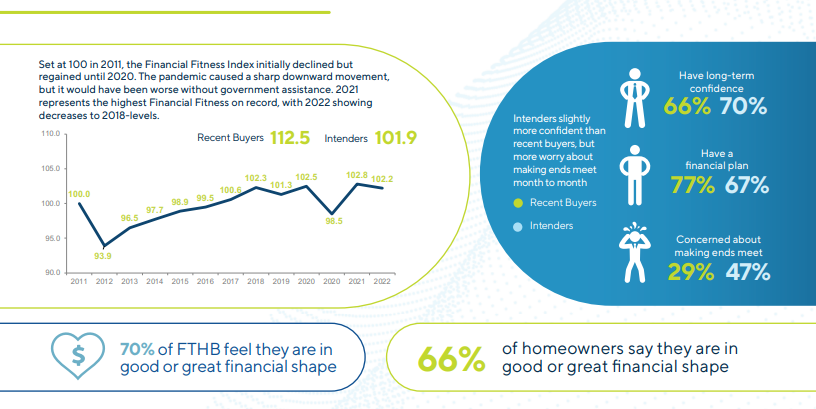

This past year saw the financial fitness of Canadians decline to 2018 levels, but recent homebuyers scored much higher according to the 2022 First-Time Homebuyer Trends conducted by Environics Research for Sagen, in collaboration with the Canadian Association of Credit Counselling Services. Of the Canadians surveyed, we saw a growing proportion of people who worry that their financial situation will worsen in the coming year. Despite these trends, respondents remain confident long-term with 66 per cent of homeowners saying that they are in good or great financial shape.

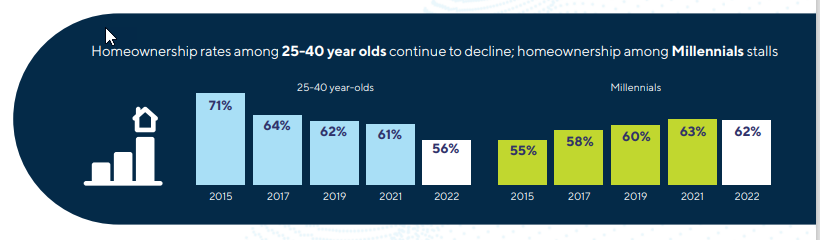

According to our survey, homeownership rates among 25- to 40-year-olds continues to decline, and homeownership rates among Millennials has stalled.

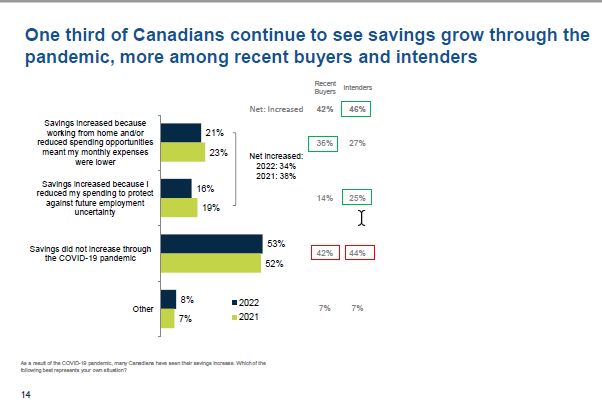

One third of Canadians continue to see savings grow through the pandemic, more among recent buyers and intenders

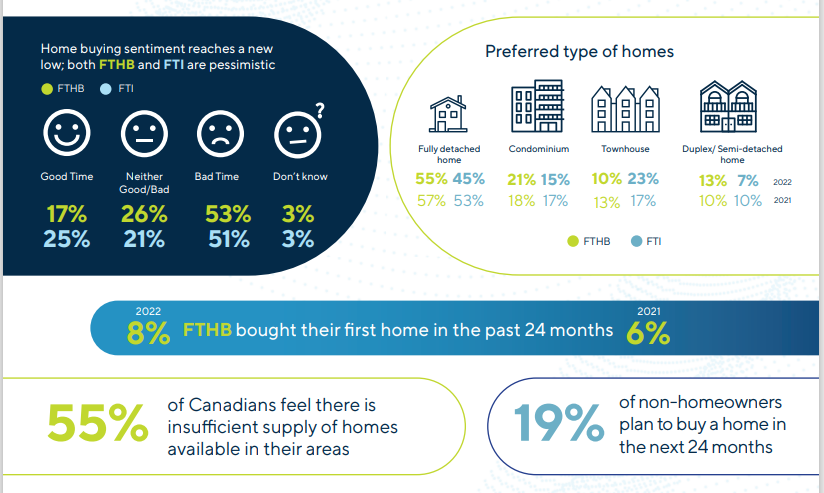

Although there’s still a strong desire for first-time homebuyers and first-time intenders to purchase a home, the lack of available supply and rising home prices in 2020 and 2021 have greatly impacted homebuying confidence, with record high proportions of respondents saying now is a bad time to buy a home. Fifty-five per cent of respondents feel there is insufficient supply of homes available in their areas. Despite these challenges, the number of first time and repeat buyers is being maintained, although we’re seeing homeownership among the 25- to 40-year-old age group at its lowest point we’ve measured.

Condos a preference

According to the survey, we saw condos grow as a preference for recent homebuyers, increasing from 18 per cent in 2021 to 21 per cent in 2022. Semi-detached homes grew in popularity, increasing from 10 per cent in 2021 to 13 per cent in 2022. Both fully detached and townhomes were not as popular during this time, decreasing from 57 per cent in 2021 to 55 per cent in 2022 and 13 per cent in 2021 to 10 per cent in 2022, respectively. Despite some changes in preferences, both recent homebuyers and future intenders continue to prefer fully detached homes.

One-third of Canadians continued to see savings grow through the pandemic, and that number was higher among recent buyers and intenders. Millennials are more likely than Boomers to say their savings increased – 38 per cent versus 29 per cent and 46 per cent of first-time intenders are more likely to say their savings increased.

First-time buyer webinar

The expectation of continued remote working is impacting purchase location decisions of a quarter of recent buyers and intenders. Even with the lack of available housing supply and high cost of home prices, the proportion of first-time and repeat buyers is being maintained.

For more information on Sagen’s annual First-Time Homebuyer Trends and their Financial Fitness, conducted by Environics Research in collaboration with the Canadian Association of Credit Counselling Services, visit sagen.ca/industry-insights.

CHBA hosted Sagen to deliver a webinar to members on this topic on Sept. 22. Watch the reply on demand at chba.ca/webinars