By Susan Carter, Vice-President, Marketing And Communications, Sagen

The housing market has undoubtedly experienced a whirlwind of economic forces over the last couple of years that have played a pivotal role in shaping first-time homebuyer sentiments and preferences. Homebuyers navigated through a maze of market influences, including home-price fluctuations, inflation, interest rate increases by the Bank of Canada (BoC) and a post-pandemic adjustment.

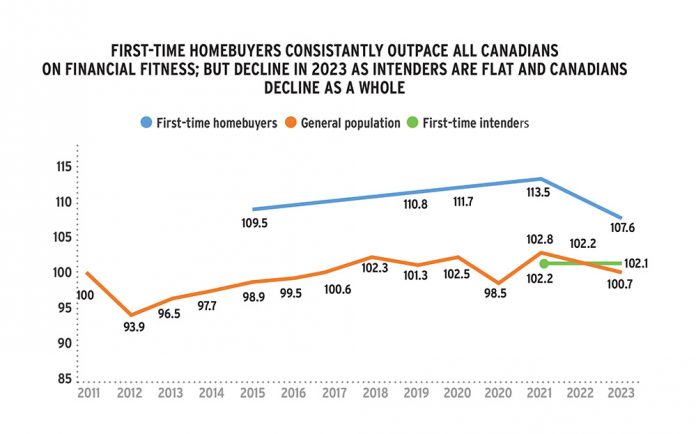

Against the backdrop of these macroeconomic factors, first-time homebuyers (those who purchased a home in the last two years) continued to outpace all Canadians when it comes to financial fitness, although first-time buyers’ financial fitness declined in 2023, compared to the results from 2021. The 2023 First-Time Homebuyer Survey and Financial Fitness Study is conducted for Sagen by Environics Research in collaboration with the Canadian Association of Credit Counselling Services, and provides a snapshot of Canadians’ homeownership attitudes and financial fitness. The study also found that the general population declined in financial fitness in 2023, while first-time intenders’ (those who intend to enter the market in the next two years) financial fitness remained flat when compared to the previous survey.

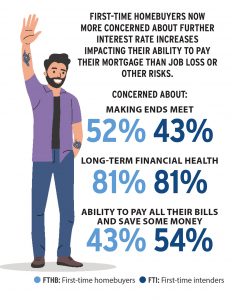

According to our survey, compared to 2021, in 2023 fewer FTHBs (first-time homebuyers) were classified into the top financial fitness segment, “looking great,” and more were classified in the middle segment, “managing.” This shift has been driven by more FTHBs saying their financial situation worsened in the past year (20 per cent in 2023, up from 12 per cent in 2021) and growing proportions who are worried about making ends meet month to month (52 per cent in 2023, up from 36 per cent in 2021).

FTHBs are voicing more concerns about their financial situations and what may come. The 2023 study results showed 78 per cent of FTHBs are now concerned about further interest rate increases impacting their ability to pay their mortgage (up 15 per cent from 2021 study results) than job loss or other risks. Despite these concerns, their behaviours show that they are still able to pay all their bills, including credit cards and mortgage payments at rates similar to prior years of this study.

Optimism for the future

Study results show that longer-term confidence remains high with both FTHBs and FTIs feeling optimistic that the future will improve. Both FTHBs and FTIs also remain much more confident than the general population when it comes to homebuyer confidence, with 43 per cent of FTHBs and 36 per cent of FTIs feeling that it’s a good time to buy a home, compared to 13 per cent of the general population that felt the same.

Buyer profiles continue to evolve

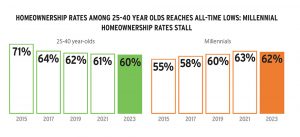

The profile of the first-time homebuyer continues to evolve with study results showing there is a declining incidence of homeownership among the core 25 to 40 age segment each year since measurement began in 2015.

In 2023, only 60 per cent of those aged 25 to 40 owned a home, down from 61 per cent in 2021 and from 71 per cent in 2015. The demographic profile of the FTHB shows that younger FTHBs and lower income FTHBs are decreasing, while there is a defined rise in homeownership among the older age spectrum (with study results showing nine per cent of FTHBs are aged 41 to 45 in 2023).

Buyer preferences and behaviours are also changing

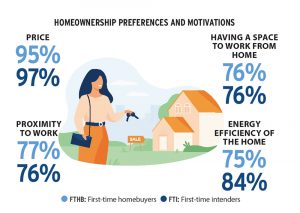

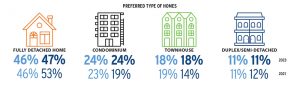

When it comes to preferred home types, affordability challenges and the desire to live closer to work have changed the types of homes being bought as well as their proximity to work. Both FTHBs and FTIs have started to shift back to purchasing a home closer to work that is smaller and more expensive.

Regardless of proximity, both groups showed a notable increased preference in having a space to work from home. Data showed that FTHBs’ preferences for condos and detached homes remained relatively the same as previous years, while more FTIs shifted their preferences towards condos.

With many are seeking space to work from home, it is little surprise that energy efficiency is an important consideration when shopping for their home.

As landscape changes, value of information is on the rise

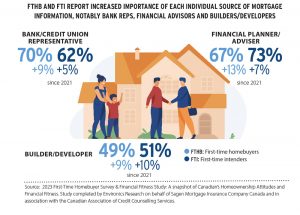

Amidst the backdrop of an ever-changing financial landscape, mortgage information continued to be more important than ever to both FTHBs and FTIs.

Study results showed an increase in the level of importance when it came to the sources that FTHBs and FTIs leveraged to learn about mortgage options, notably with bank representatives, financial advisors and builders/developers, who each rose in importance since the previous survey.

For more information about the results of Sagen’s First-Time Homebuyer Survey and Financial Fitness Study, visit sagen.ca/industry-insights.